direct vs indirect cash flow forecasting

Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times. That starts by choosing between the direct and indirect cash flow methods.

2022 Cfa Level I Exam Cfa Study Preparation

Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

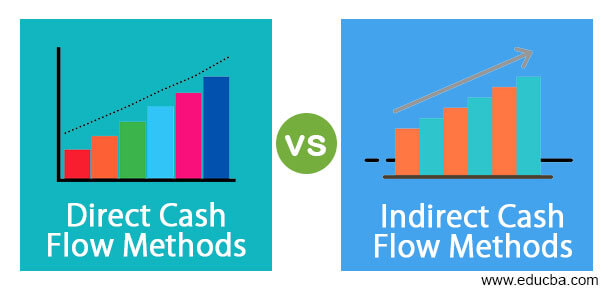

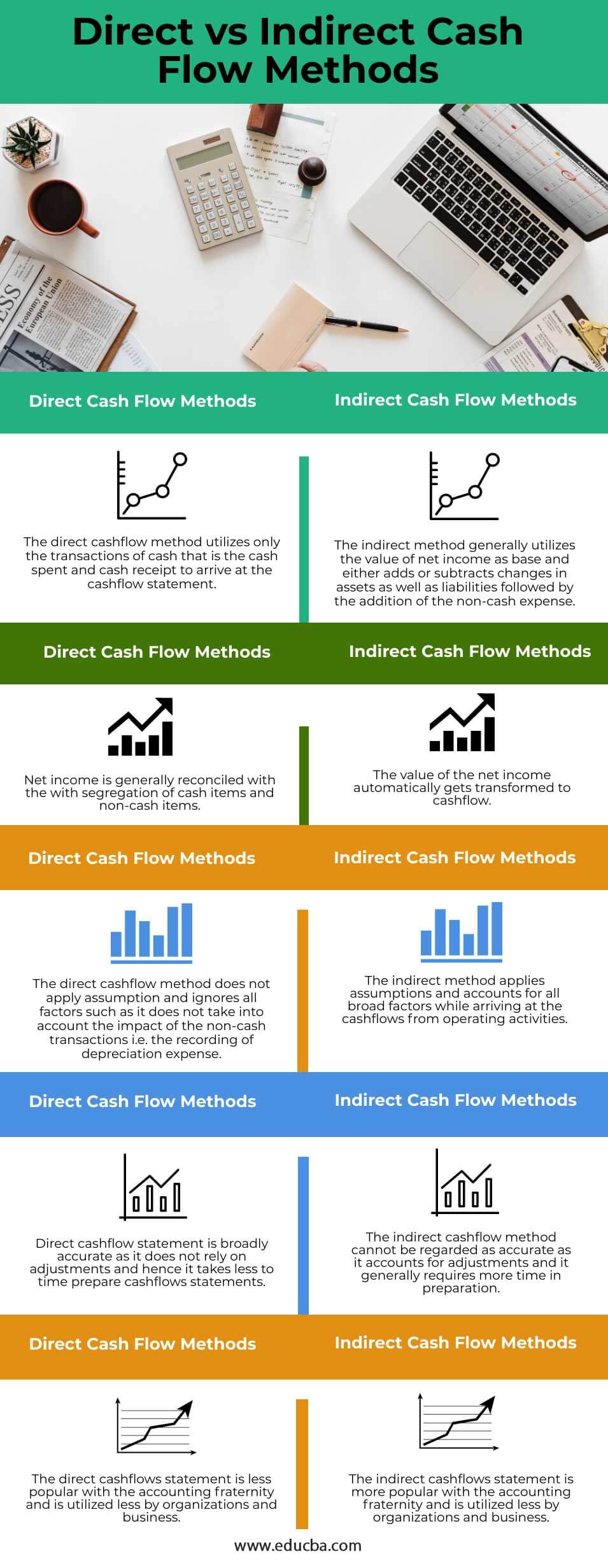

. The indirect method takes net income as the basis for calculation and requires you to make adjustments to this according to items that are excluded from the profit and loss statement. The direct cash flow forecasting formula is exactly what you would expect. Cash flow direct method.

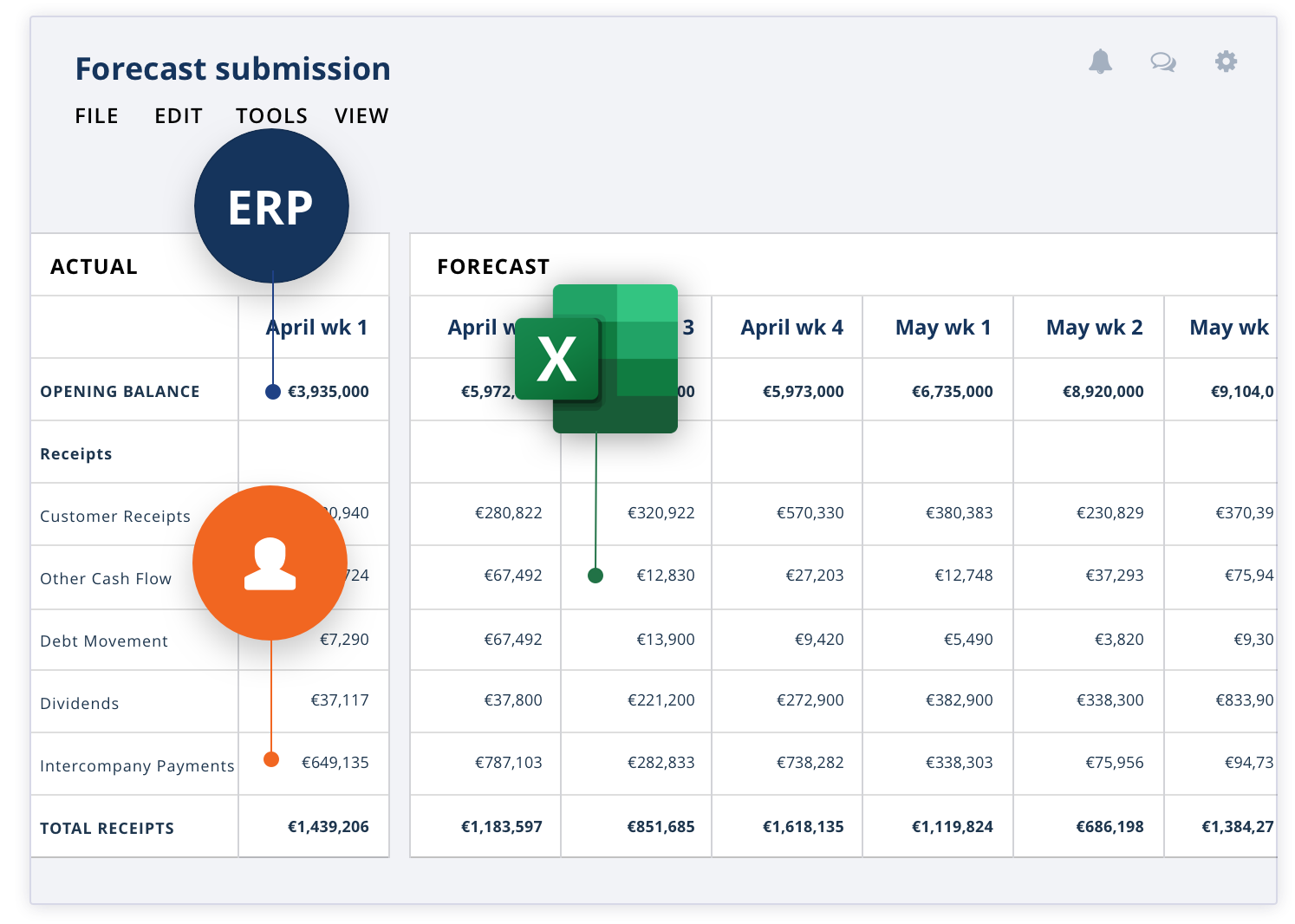

A cash flow forecast is about predicting cash flows in advance. 1 Calculating Cash Flow 2 The Direct Method vs. CASH FLOW FORECASTING AND LIQUIDITY MANAGMENT.

The basis for comparison between Direct vs. This is an essential part of measuring day-to-day cash flows and knowing. Indirect Cash Flow Forecasting.

The indirect method is widely used by many businesses. IAS 7 and Section 230-10-45 FASB Statement No. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements.

You can perform a cash flow forecasting using either the direct or indirect method. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities. When looking at the different methods for creating a statement of cash flows it is key to understand that neither method provides a more.

Up to 5 cash back 5412 Comparison with the Reconciliation Method under US. The direct method is less commonly used but much easier to calculate. The main difference between the two methods relates to the cash.

The indirect method uses net income as a base and adds. Forecast your future cash position and regain your control on your business finances. It is a simple way of calculating your cash flow and can be done quickly from data readily available in your.

Direct cash forecasting is a method of forecasting cash flows and balances used for short term liquidity management purposes. The most commonly used method for cash flow forecasting is the indirect method. Cash flow indirect method.

It is used for long-term forecasts which range from one year to five years. Eventually youll need to switch to indirect cash flow. The direct method ideal for shorter.

There are two ways to do a cash flow forecast both are. Forecast your future cash position and regain your control on your business finances. Indirect method of cash flow.

Direct method touted as best way to forecast cash flow. Direct vs indirect cashflow forecasting Fluidly Free Samples and Examples of The indirect cash flow statement method does not include the level of detail that you would Direct. The traditional indirect method while necessary for financial reporting isnt well-suited for planning finance.

Direct and indirect are two different methods that are used in preparing the cash flow statement of your company. Analysis and management of cash flows include computing the time of circulation of cash analyzing cash flow forecasting it determining the optimal level of cash drawing up. 95 permit the direct and the indirect method of.

Indirect Method 3 How to Choose Between.

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Free Cash Flow Forecast Templates Smartsheet Cash Flow Personal Finance Budget Templates

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Cash Flow Statement Direct Method Cash Flow Statement Direct Method Statement Template

How Direct Cash Flow Models Help Predict Liquidity Wsj

Cash Flows Operating Activities Direct Vs Indirect Method Accounting Financial Tax

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn