hawaii capital gains tax rate 2021

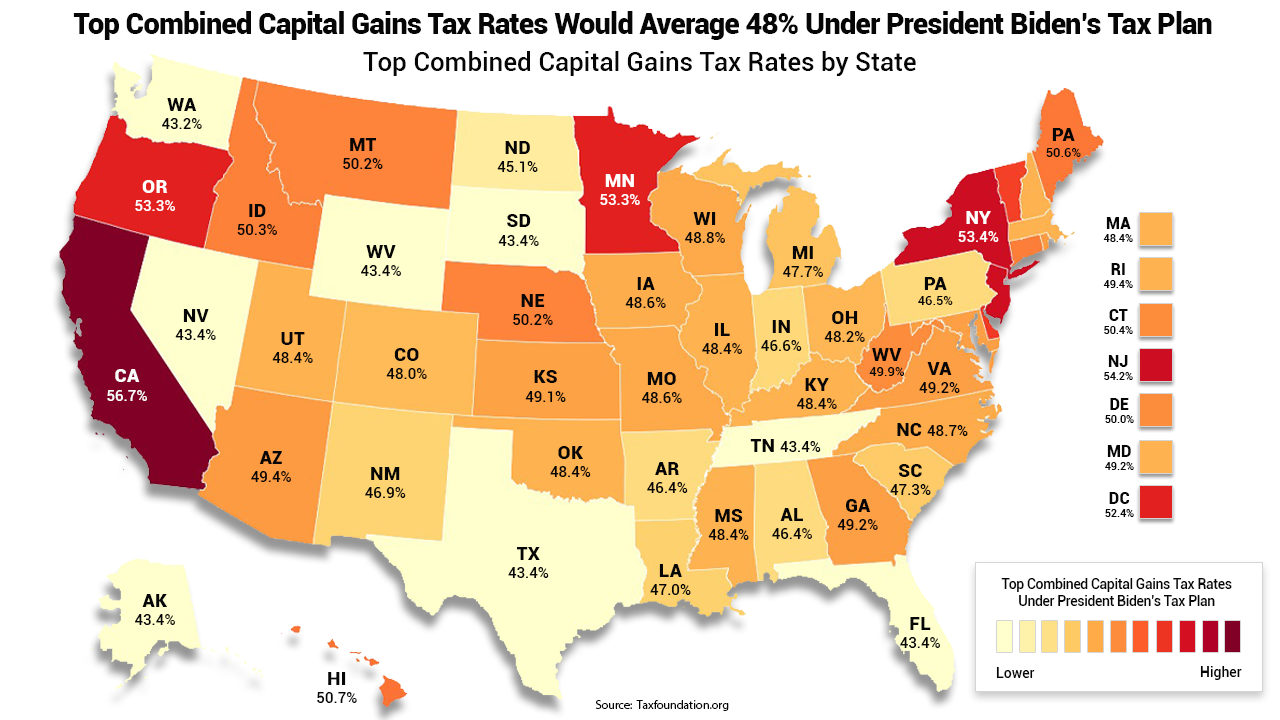

Introduced and Pass First Reading. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which increases the tax rate by 118 percent.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Provisional 2022 tax rates are based on Hawaiis 2021 income tax.

. There is currently a bill that if passed would increase the. Capital gains tax rates on most assets held for a year or less correspond to. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

Are Delaware Statutory Trusts Right for You. Sort by Date Status Text. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Investors Guidebook to. That applies to both long- and.

Most governments tax capital capital gains and corporate income less than labor. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more.

Hawaiis capital gains tax rate is 725. IWKLVLVWKHQDOUHWXUQRIWKHWUXVWRUGHFHGHQWVHVWDWH DOVRHQWHURQOLQH F 6FKHGXOH. Marginal tax rates in the county Highest Marginal Tax Bracket 1 California 1330 2 Hawaii 1100.

1 increases the Hawaii income tax rate on capital gains from 725 to 9. Short-term gains are taxed as ordinary income. The Hawaii State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Hawaii State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Start filing your tax return now. That applies to both long- and short-term capital gains. 35 Tax Computation Using Maximum Capital Gains Rate Complete this part only if lines 16 and 17 column b are net capital gains.

The bill has a defective effective date of July 1 2050. Increases the alternative capital gains tax for corporations from 4 to 5. Capital gains tax rates on most assets held for.

The current top capital gains tax rate is 725 percent which critics point out is a lower tax rate than many Hawaiʻi residents pay on their wages and salaries. Increases the capital gains tax threshold from 725 to 9. Hawaiis tax system ranks 41st overall on our 2022 State Business Tax Climate Index.

Each states tax code is a multifaceted system with many moving parts and Hawaii is no exception. You will pay either 0 15 or 20 in tax on long-term. The capital gains tax is imposed on the profits from sales of capital assets such as houses stocks bonds or jewelry.

If zero or less enter zero. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021.

Additional State Income Tax Information for Hawaii. Raise Revenue Tax Fairness. A new version of HB 133 as amended in the Ways and Means Committee on Monday would increase the top capital gains tax rate to 9 for individuals and increase the top.

The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. This is your long-term capital loss carryover from 2021 to 2022. Under current law a 44 tax.

Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022. SAYAMA ICHIYAMA KAPELA Matayoshi. Income Tax Tax Review Commission TAX RESEARCH PLANNING DOTAX SETH COLBY JAN 20TH 2021 1.

To qualify for this exemption you cannot have excluded the gain on the sale of another home within two years to. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status.

The Hawaii Department of Revenue is responsible for publishing the latest Hawaii State. Hawaii has a 400 percent state sales tax rate a 050 percent max local sales tax rate and an average combined state and local sales tax rate of 444 percent. Referred to FIN referral.

2021 Capital Gains Tax Rates By State Smartasset The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20. Before the official 2022 Hawaii income tax rates are released provisional 2022 tax rates are based on Hawaiis 2021 income tax brackets. Hawaii Capital Gains Tax.

Detailed Hawaii state income tax rates and brackets are available on this page.

Tax Fairness Is Popular And Needed For Hawaii S Future Hbpc

The States With The Highest Capital Gains Tax Rates The Motley Fool

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Biden S Proposed Capital Gains Tax Hike Might Hit Wealthy Americans With 57 Rate Study Shows Fox Business

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

Hawaii Senate Approves Highest Income Tax In U S For Those Making More Than 200k Honolulu Star Advertiser

Testimony Sb2485 Cites Tax Fairness In Proposing State Capital Gains Tax Increase Grassroot Institute Of Hawaii

State Income Tax Rates Highest Lowest 2021 Changes

Capital Gains Tax Calculator 2022 Casaplorer

How High Are Capital Gains Taxes In Your State Tax Foundation

Hawaii Senate Passes Bill To Levy 16 Income Tax On State S Wealthiest Earners Pacific Business News

Mapped Biden S Capital Gain Tax Increase Proposal By State

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2021 Capital Gains Tax Rates By State Smartasset

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

Long Term Capital Gains Tax What It Is How To Calculate It Seeking Alpha